Common Stock: AquaChile

Current Market Price: $448.11 (CLP) $0.61 (USD)

Market Capitalization: $725.5 Billion (CLP) $988 Million (USD)

*All values in this article are expressed in united States Dollars (USD) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

AquaChile Stock – Summary of the Company

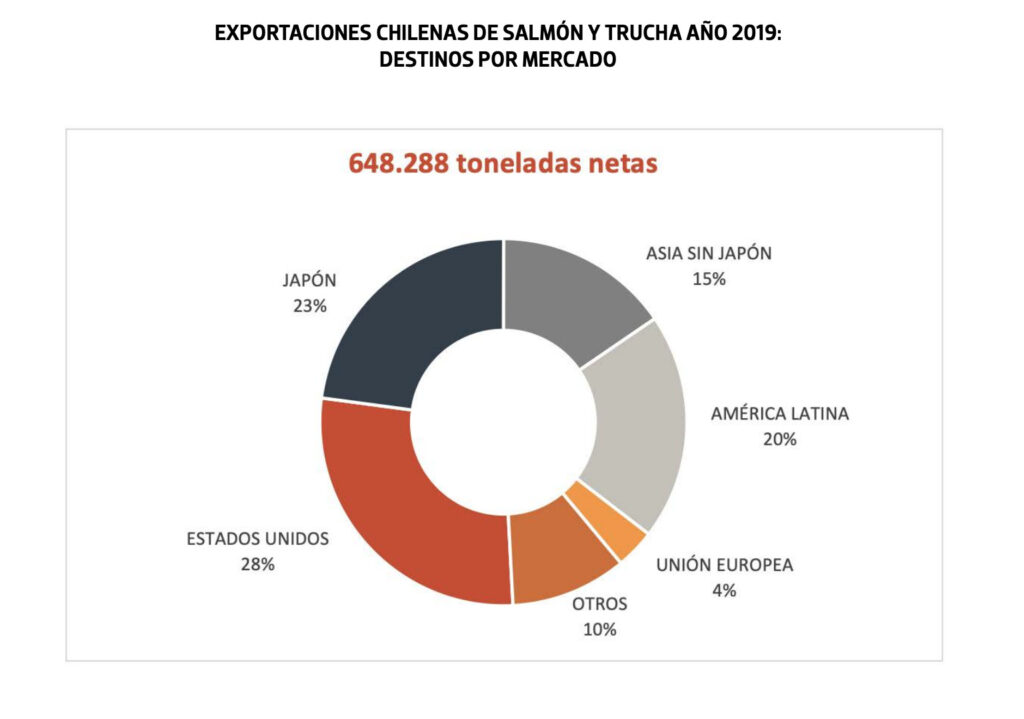

AquaChile is a Chilean fish company. Their main product is Salmon, but they also produce relevant amounts of trout and tilapia. In 2019 AquaChile was the largest Chilean exporter of salmon and trout. Most of the company’s exports go to The United States and Japan, but Latin America and Asia ex-Japan are also relevant markets for the company. They have 360 major clients, spread across 47 countries.

AquaChile was founded in 1979 and is headquartered in Puerto Montt, Chile. The company employs over 5,000 people.

Revenue and Cost Analysis

AquaChile had revenue of $1.1 billion in 2019, a significant increase from $716.2 million in 2018. Their COGS was $1 billion in 2019, representing a gross margin of 12%, a significant decrease compared to 18.7% in 2018.

The company was profitable in both 2019 and 2018. In 2019 AquaChile had net income of $67.3 million, representing a profit margin of 5.6%, a deterioration compared to 10.9% in 2018.

Balance Sheet Analysis

AquaChile has a sound balance sheet. They have a solid base of assets and sufficient liquidity in the near term. Liability levels are reasonable, with low long term labilities.

AquaChile Stock – Share Dynamics and Capital Structure

As of year-end 2019, the company has 1.6 billion common shares outstanding. The company’s largest shareholder, AgroSuper S.A. controls 100% of the company’s shares.

AquaChile – Dividends

AquaChile did not pay a dividend in 2019.

AquaChile Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$573.5 million / $912 million = .63

A debt to equity ratio of .63 indicates that AquaChile uses a mix of debt and equity in its capital structure, but is not leveraged, and relies more heavily on equity financing for funding.

Working Capital Ratio

Current Assets/Current Liabilities

$775.3 million / $462.5 million = 1.7

A working capital ratio of 1.7 indicates a sufficient liquidity position. AquaChile should not have problems meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

$0.61 / $0.56 = 1.08

AquaChile has a book value per share of $0.56. At the current market price this implies a price to book ratio of 1.08, meaning the company’s stock currently trades at a slight premium to the book value of the company.

AquaChile Stock – Summary and Conclusions

AquaChile is an intriguing company. They are one of the largest fish exporters in Chile and present in 47 countries. The company appears to be in decent financial health, with sufficient liquidity and a profit.

However I will need to do further research. The company’s stock has an active price, but their financials state the company is 100% owned by AgroSuper. I will need to wait for the company’s 2020 financials to be made available (if the company is still public) before drawing any conclusions.

Investors can compare AquaChile stock to Brazilian meat exporters Marfrig and Minerva.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.