Common Stock: Almaden Minerals (TSX: AMM)

Current Market Price: $.91 CAD

Market Capitalization: $101.6 million CAD

**Note: All values in this article are expressed in Canadian Dollars (CAD) unless otherwise noted.

Almaden Minerals Stock – Summary of the Company

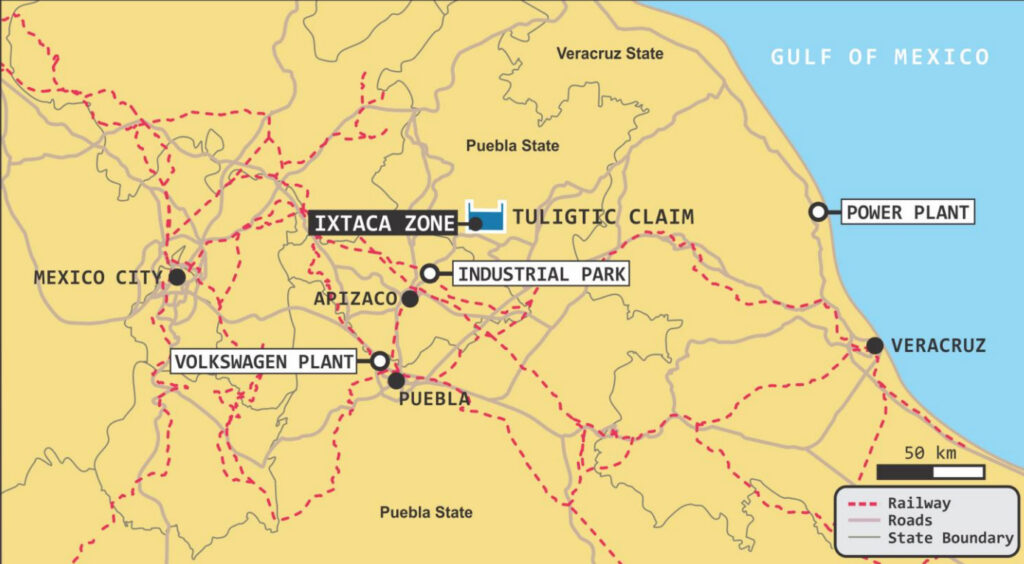

Almaden Minerals is a precious metals exploration company focused on the acquisition, exploration, and development of precious metals properties in Mexico. Their main focus is their 100% owned Ixtaca project located in Puebla Mexico. Almaden has released a feasibility study and is currently in the permitting phase. The company was founded in 2002 and is headquartered in Vancouver Canada.

Revenue and Cost Analysis

Almaden Minerals does not have any properties that are currently producing and therefore does not have any revenue. They consistently run a net loss and are likely to continue to do so for the foreseeable future.

In 2019, the company had a net loss of $3.7 million, on par with its 2018 net loss of $3.5 million. The company’s largest expense in both years were compensation related, including share based compensation.

Almaden Minerals – Royalty and Streaming Agreements

The Ixtaca project is subject to a 2% net smelter royalty.

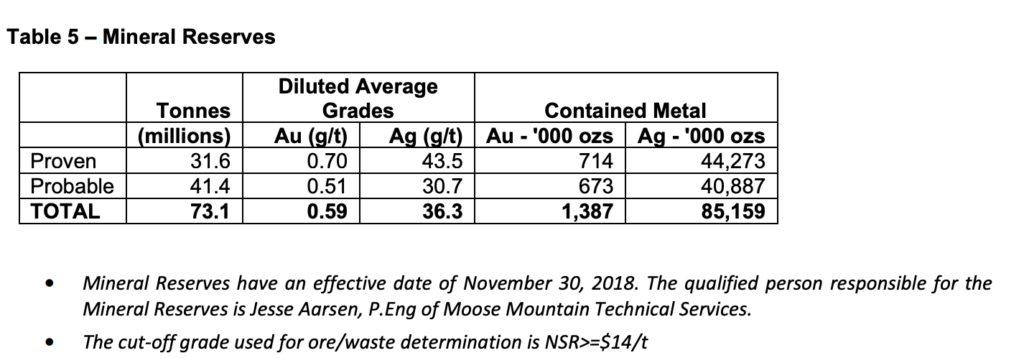

Almaden Minerals – Mineral Resources

The Ixtaca project has proven and probable resources totaling 1.38 million ounces of gold and 85.1 million ounces of silver.

Balance Sheet Analysis

Almaden has a decent balance sheet. They have sufficient liquidity and reasonable liability levels. The only concerning item, given that they have no revenue, is their gold loan (discussed below).

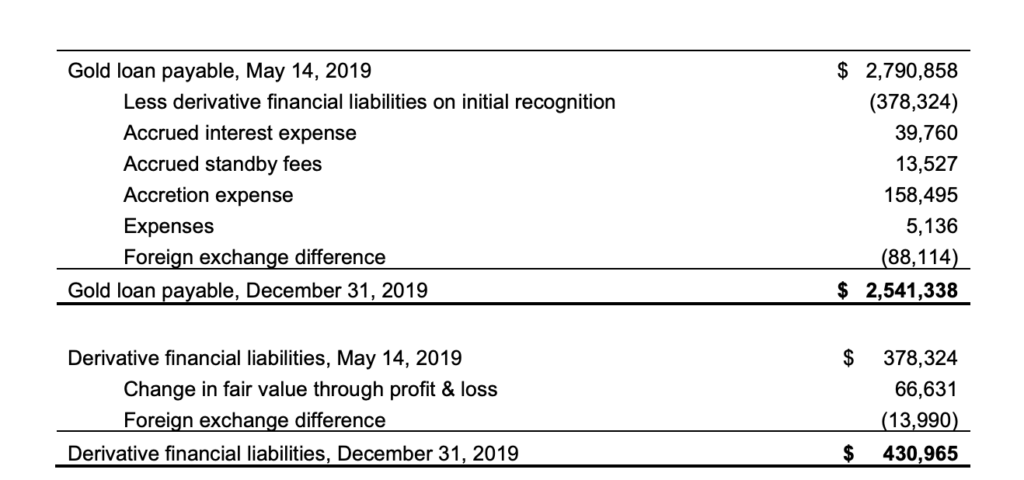

Almaden Minerals – Debt Analysis

As of year-end 2019 Almaden has a gold loan payable valued at $2.5 million. They are able to borrow up to 1,597 ounces, drawing down in minimum trances of 400 ounces. The loan matures March 2024 and carries an interest rate of 10%.

Almaden Minerals Stock – Share Dynamics and Capital Structure

As of March 2020, Almaden had 111.7 million common shares outstanding. In addition, the had 10.3 million warrants and 9.9 million options outstanding. Fully diluted shares outstanding is around 131.9 million shares.

Almaden has a dilutive capital structure. Investors should consider the effects of potential dilution before investing.

Almaden Minerals Stock – Dividends

The company does not pay a dividend and is unlikely to do so for the foreseeable future.

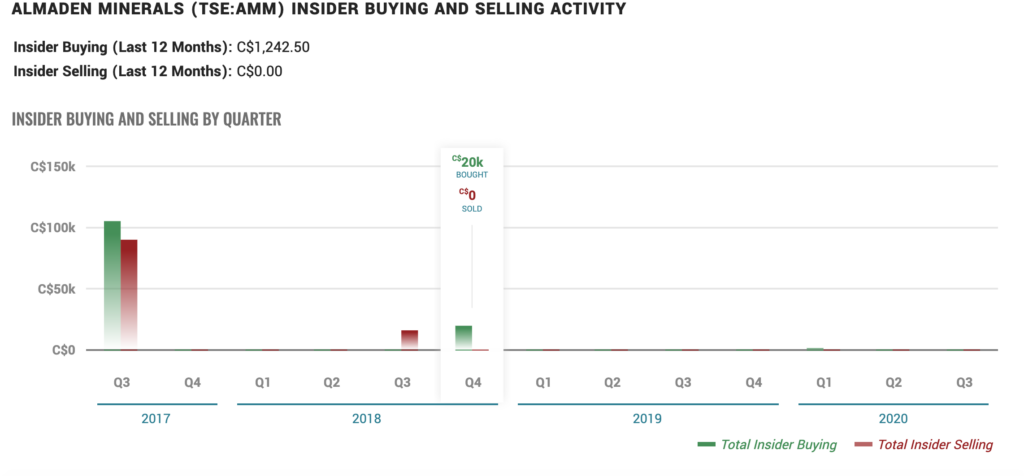

Management – Skin in the game

Insiders at Almaden Minerals have not made any relevant transactions in the company’s stock recently, providing no signal to investors.

Almaden Minerals Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$5.4 million/$68.5 million = .07

A debt to equity ratio of .07 indicates that Almaden uses a small amount of debt in its capital structure, but relies mostly on equity financing to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

$2.6 million/ $900 thousand = 2.9

A working capital ratio of 2.9 indicates sufficient liquidity. Almaden should not have problems meeting its short-term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

$.91/$.52 = 1.75

Based on fully diluted shares outstanding Almaden Minerals has a book value per share of $.52. At the current market price this implies a price to book ratio of 1.75, meaning the company’s stock trades at a slight premium to the book value of the company.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

Almaden Minerals Stock – Summary and Conclusions

Almaden has a solid project with a large gold and silver resource. The project continues to advance and has the potential to develop into a producing mine. The company has some dilutive instruments outstanding and has already taken out debt, both of which are concerning to potential investors. Additionally, investors need to consider the risks associated with a single asset company in a risky jurisdiction.

Given the size of the resources and the fact the company is currently trading well below the NPV of the project, a small allocation to Almaden Minerals stock may be interesting for highly risk tolerant investors within a diversified precious metals portfolio. To offset some of the development risks, pairing this allocation to a gold and silver producer such as Fortuna Silver is also worth considering. For now I would prefer to continue to allocate to Fortuna, but I will continue to monitor the project and may allocate in the near future.