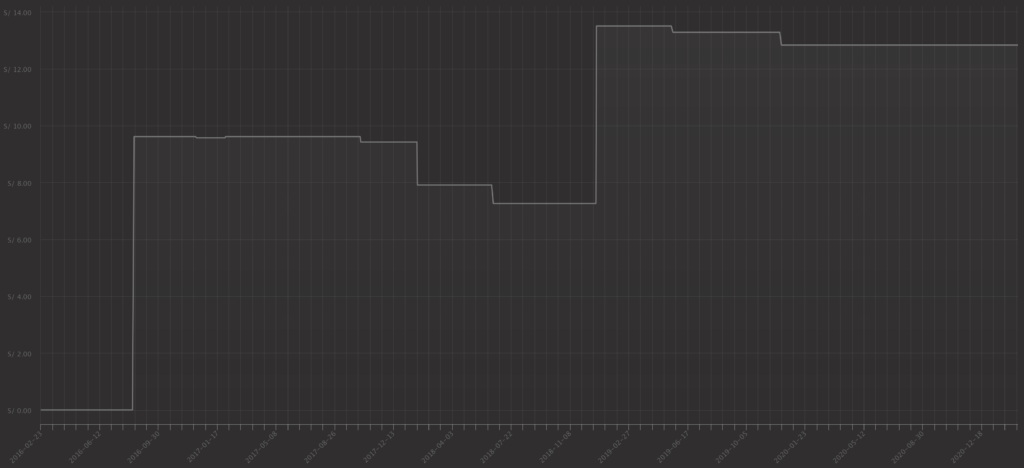

Common Stock: Agrokasa (AGROKAC1)

Current Market Price: $12.83 PEN

Market Capitalization: $853 Million PEN

*All values in this article are expressed in United States Dollars (USD) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Agrokasa Stock – Summary of the Company

Agrokasa is a Peruvian agriculture company. They produce, package, and sell fresh blueberries, table grapes, avocados, and asparagus. The company has over 7,400 hectares of land under management and operates four processing and packaging plants in Peru. Their main export markets are The United States, Europe, and Asia. Agrokasa was founded in 2011 and is headquartered in Lima, Peru.

Revenue and Cost Analysis

Agrokasa had total revenue of $112.8 million in 2019, an increase from $107.2 million in 2018. Their COGS was $76.2 million in 2019, representing a gross margin of 32%, a significant increase compared to 26% in 2018.

The company was profitable in each of the last two years. In 2019 Agrokasa had net income of $23.5 million, representing a profit margin of 21%, a significant improvement compared to 12% the previous year.

Balance Sheet Analysis

Agrokasa has a decent balance sheet. They have sufficient liquidity in the near term and a solid base of long term assets. Liability levels are reasonable, although they do have relevant amounts of debt outstanding.

Agrokasa – Debt Analysis

As of year end 2019 the company has $22.8 million in debt outstanding, almost all of which is classified as current.

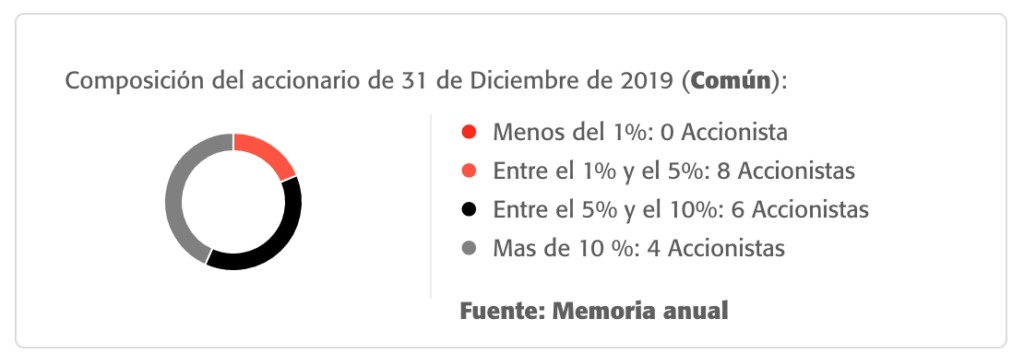

Agrokasa Stock – Share Dynamics and Capital Structure

As of year-end 2019 the company has 66.5 million common shares outstanding. The company’s shares are tightly held, with a total of only 18 shareholders, 10 of which own a stake of over 5%.

Agrokasa Stock – Dividends

In 2019 the company paid total dividends of $0.20 cents per share. At the current market price this implies a dividend yield of 5.7%.

Agrokasa Stock – 2 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$55.8 million / $209.4 million = .27

A debt to equity ratio of .27 indicates that Agrokasa uses a mix of debt and equity in its capital structure, but is not leveraged, and relies mostly on equity financing to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

$58.6 million / $42 million = 1.4

A working capital ratio of 1.4 indicates a sufficient, but not strong liquidity position. Agrokasa should not have problems meeting its near term obligations.

Agrokasa Stock – Summary and Conclusions

Agrokasa is an interesting company. They are a large fresh fruit producer with significant exports. The company is very sound financially, with sufficient liquidity, profits, and a dividend to shareholders.

Although I love their business, the company’s shares are too thinly held for me to take a position, I’m not even sure it would be possible if I wanted to. Investors can consider a more liquid Latin American agriculture company, such as Brasil Agro.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.