Common Stock: 138 Student Living Jamaica

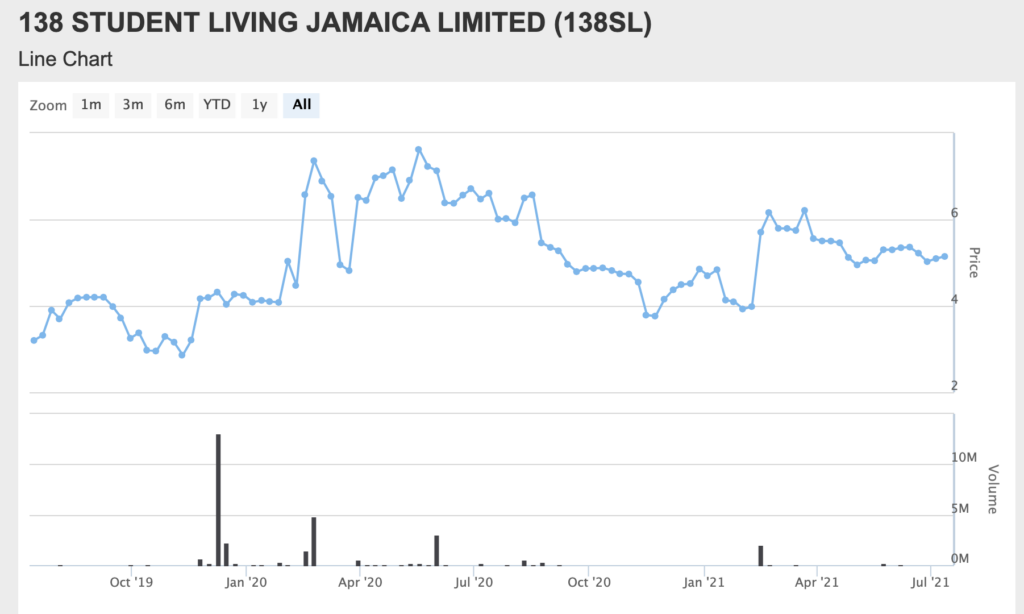

Current Market Price: $4.80 JMD

Market Capitalization: $2 Billion JMD ($13 million USD)

*All values in this article are expressed in Jamaican Dollars (JMD) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

138 Student Living – Summary of the Company

138 Student Living is a Jamaican real estate company focused entirely on providing student housing to the University of West indies in Kingston, Jamaica. The company has a 65 year concession which began in 2014. This concession required the company to build and operate 1,584 units of student housing, as well as restore an additional 722 units.

Revenue and Cost Analysis

138 Student living had total revenue of $1.2 billion JMD ($7.9 million USD) in the fiscal year 2020. This represents an increase from $1 billion in 2019. The company was profitable in each of the past two years. In 2020 they had net income of $316.8 million, representing a profit margin of 26%, a significant increase from 2% the previous year. The company’s increase in profitability is due to lower financing and tax expenses.

Balance Sheet Analysis

The company has a weak balance sheet. Their liquidity position in the near term is weak and the company may face difficulties meeting its obligations. Long term they have significant debt outstanding.

Debt Analysis

As of year-end 2020 the company has $4.5 billion in total debt outstanding, $301 million of which is classified as current. The company pays interest rates ranging between 9%-12%.

138 Student Living – Share Dynamics and Capital Structure

As of year-end 2020 the company has 414.5 million common shares outstanding.

Dividends

The company does not pay a dividend to common shareholders, only preferred.

138 Student Living Stock – 2 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$5.5 billion / $4.5 billion = 1.2

A debt to equity ratio of 1.2 indicates that the company uses a mix of debt and equity in its capital structure, but is leveraged and relies more heavily on debt financing.

Working Capital Ratio

Current Assets/Current Liabilities

$947 million / $ 1.2 billion = .80

A working capital ratio of .80 indicates a weak liquidity position. 138 Living may have problems meeting its near term obligations. Investors should monitor the company’s liquidity closely.

138 Student Living Stock – Summary and Conclusions

The nature of higher education is changing rapidly due to online alternatives. Long term I would not want to invest in any student housing company, anywhere in the world. 138 Student living is in a weak financial position. Even if I wanted to invest in student housing, 138 student living stock is not investable. Aggressive investors can consider shorting the stock. However its small market cap and low liquidity make this a difficult stock to short.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.